Intel Announces FY 2015 Q3 Results: Strong Earnings Despite Client Computing Drop

by Brett Howse on October 13, 2015 7:55 PM EST- Posted in

- CPUs

- Intel

- Financial Results

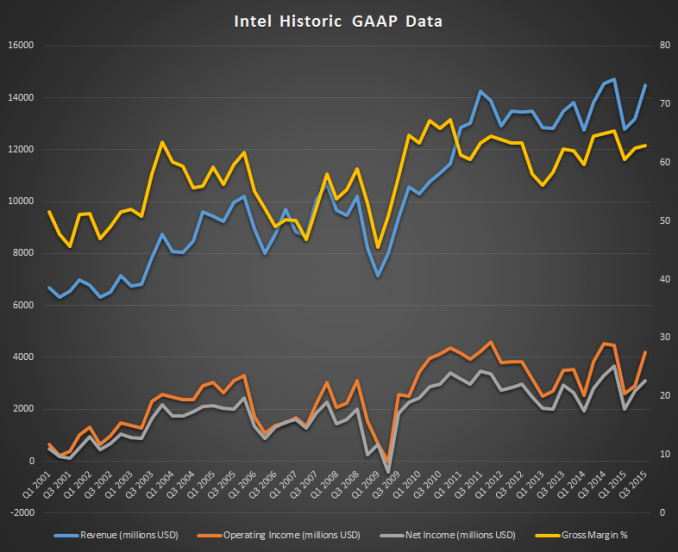

Intel released their third quarter earnings for fiscal year 2015 today, and it was certainly a rocky quarter. Their revenue for the quarter was $14.5 billion, which was in-line with their expectations, and revenues were flat as compared to Q3 of 2014. They actually did very well to remain flat though since the Client Computing Group struggled due to the combination of PC and tablet sales. Gross margin was down slightly to 63%, and operating income and net income were also down 8% to $4.2 billion and $3.1 billion respectively. Earnings per share fell 3% to $0.66.

| Intel Q3 2015 Financial Results (GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | |||

| Revenue | $14.5B | $13.2B | $14.5B | ||

| Operating Income | $4.2B | $2.9B | $4.5B | ||

| Net Income | $3.1B | $2.7B | $3.3B | ||

| Gross Margin | 63.0% | 62.5% | 65.0% | ||

| Client Computing Group Revenue | $8.5B | +13% | -7% | ||

| Data Center Group Revenue | $4.1B | +8% | +12% | ||

| Internet of Things Revenue | $581M | +4% | +10% | ||

| Software and Services Revenue | $556M | flat | +4% | ||

| All Other Revenue | $682M | -5% | +19% | ||

In Q3, Intel launched Skylake which is their 6th generation Core processor, and the also announced their 3D X-Point memory technology. Sales of Skylake have just begun, and I would expect to see a broader rollout in Q4. The memory tech is still going to be a while before we see it in a purchasable product.

The biggest underperformer from Intel was the Client Computing Group. Revenue for this group was down 7% to $8.5 billion with platform volumes down 19%. This was somewhat helped by an increase in Average Selling Price (ASP) of 15%. Notebooks and desktops were down 14% and 15% respectively, and ASP for these units were up 4% and 8%. The PC market is certainly struggling despite the rollout of Windows 10 and Skylake. The free upgrade for Windows 10 certainly won’t be helping matters. But the biggest drop from Intel was in the tablet sector, where Intel powered tablet sales were down 39%. The tablet market is almost like a compressed version of the PC market when looked at over time.

Intel’s Data Center Group had a much stronger quarter. Revenue was $4.1 billion, up 12%, which was driven by platform volume up 6% and ASP also up 6%. Much of this was driven by growth in cloud computing which is growing even faster than Intel had predicted.

The remainder of their revenue came from Internet of Things which had growth of 10% to $581 million, Software and services had a flat revenue of $556 million, and the “all other” segment had 19% growth to $682 million.

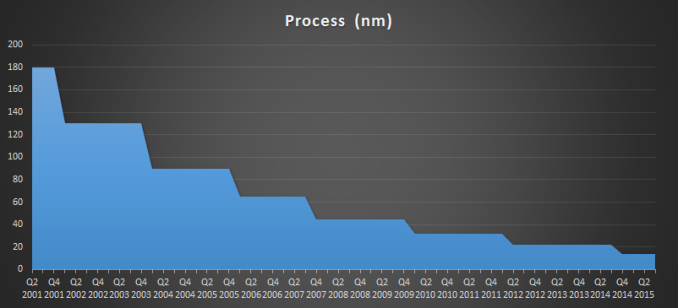

Looking forward for Q4, Intel is looking for revenues of $14.8 billion plus or minus $500 million, which would be up 2% from Q3, and gross margin is expected to drop 1.0% to 62%. The drop in margin is attributed to a ramp up of their Ireland fab ahead of schedule which is outputting wafers at a higher cost than the more established fabs for the time being. In addition, the costs for 14 nm is still higher per chip than 22 nm, but the percentage of 14 nm to 22 nm is certainly shifting towards the newer process which drives down margins.

I think the overall quarter is actually fairly good for Intel. Despite a definite drop in the PC market, they managed to make up most of that with a strong showing in cloud computing. The ramp up to Skylake and Windows 10 should start in full in Q4. Intel seems cautiously optimistic that the rollout of Windows 10, especially in enterprise, should be much quicker than the last upgrade which should help sales.

Source: Intel Investor Relations

23 Comments

View All Comments

Shadow7037932 - Tuesday, October 13, 2015 - link

Ouch. 39% drop in tablet sales. I guess this is to be expected as tablets overall don't seem to be doing very hot right now.nofumble62 - Tuesday, October 13, 2015 - link

Actually it's a good news. The end of contra-revenuenathanddrews - Wednesday, October 14, 2015 - link

I, for one, will gladly continue to shop Intel's clearance rack.Morawka - Wednesday, October 14, 2015 - link

that's not year over year,, thats just the quarter.. Its not as bad as you might think.Intel's Performance cpu's are just now starting to use 5w of power... imagine in in a couple of years when 10nm is out and you have core i5 performance in a fanless 5w package. And the low power stuff can be used in phones at 2.5w

medi03 - Thursday, October 15, 2015 - link

And why on earth would anyone want that? Exactly what would Intel's chip in a phone do, what ARMs do not?mrdude - Tuesday, October 13, 2015 - link

Another dip in CAPEX at -$400million.This doesn't exactly exude confidence from a fab perspective or even longer term performance. Not when Samsung and TSMC are increasing spending and even exceeding Intel.

witeken - Wednesday, October 14, 2015 - link

The 400M drop is irrelevant:Stacy Smith: "Actually, it’s a pretty specific issue this quarter. We upgraded the configuration of a specific piece of equipment that we were going to buy [indiscernible] some delivery slots that were towards the end of this year. As we upgraded to a richer configuration, it swapped out to delivery slots from the end of this year, to Q1 of next year. So just shifted a few hundred million dollars worth of CapEx from 2015 to 2016."

Capex really doesn't matter. What matters is that they get yields where they have to be so they can start HVM.

mrdude - Wednesday, October 14, 2015 - link

Amazing how spending is irrelevant now that Intel has fallen behind on that front. I seem to recall that Intel's lead was primarily attributed to spending.14nm still has issues though attributable to cost. Capex dropping, volume dipping, and process advancements being pushed out are all related. You're delusional if you think otherwise.

Intel's lead is nonexistent in mobile despite the supposed process advantages. Is it the uarch or the fabs that are the problem? Given the capex trend, I'm inclined to believe it's both -- if not, then certainly in the future.

They're ER looks decent because of increased asps in declining market with respect to volume. That's not a healthy business plan

extide - Wednesday, October 14, 2015 - link

The issue is the uarch. What intel needs to do is build a soc with core IP instead of Atom IP. They never will because they want to protect their higher price items, which is a shame. A SOC with core IP, very limited PCIe (maybe 2-4 lanes) and a built in modem, etc would be an amazing smartphone soc.mrdude - Wednesday, October 14, 2015 - link

If you listen to the conference call, there's a tacit admission that Intel is pulling out of the mobile market and looking more to IoT to bring in appreciable volume, albeit at a more reasonable time frame -- years, not months.With respect to modem, Intel has historically had lots of problems producing modems on its fabs. Even today the majority of consumer-facing modems are built at TSMC and not on Intel's own foundries. And producing them is one thing, making them at reasonable costs (read: low costs and high volume intended for the mobile market) is an entirely separate problem that doesn't jive with their cost structure.

We have Core-M, but compare that to the A9X and then consider the form factor. Apple's A9X can maintain its CPU frequency almost indefinitely with no GPU load, whereas Intel's Core-M throttles aggressively under the same conditions at a higher TDP and better cooling. Then consider the performance gap; or rather, what gap there is left.

Intel doesn't rule the roost anymore. The capex spending dipping at a time it should be increasing at an accelerating rate is evidence enough, imo. The fab advantage may be here now (and only when compared to AMD), but going forward Intel will be in a lot of trouble.