Intel Announces Q2 FY 2016 Earnings

by Brett Howse on July 20, 2016 11:55 PM EST- Posted in

- CPUs

- Intel

- Financial Results

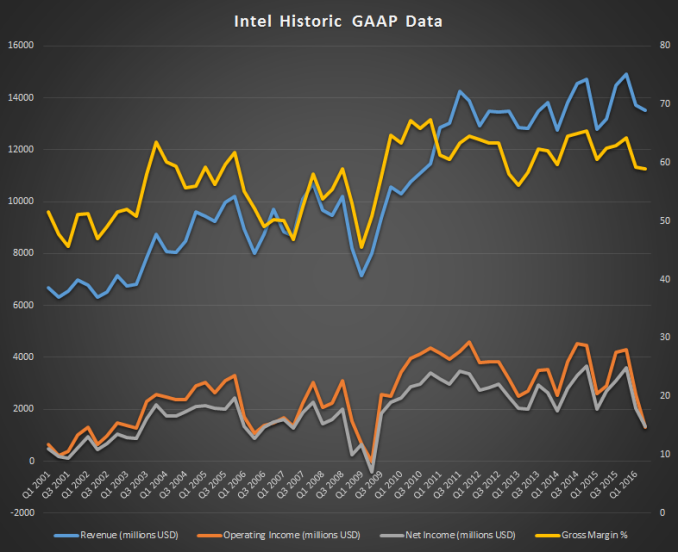

In addition to the interesting tidbit about Kaby Lake, Intel also found time today to announce their second quarter earnings for fiscal year 2016. Revenue was up 3% year-over-year, but net income and earnings per share took a big hit due to the restructuring announced in Q1. Revenue for the quarter was $13.5 billion, and while gross margin was down 3.6% to 58.9%, Intel did exceed their outlook on margins. Operating income for the quarter was $1.3 billion, compared to $2.9 billion a year ago, and net income was $1.3 billion as well, down from $2.7 billion last year. Earnings per share came in at $0.27 per share, down 51% from the $0.55 result a year ago.

To account for the restructuring fees and other charges, Intel has also released Non-GAAP results. Revenue was the same at $13.5 billion, and gross margin was 61.8%, which was down 1.3% from a year ago. Operating income was $3.2 billion, down 2% from last year, and net income was down 6% to $2.9 billion. Non-GAAP earnings per share came in at $0.59 per share, down 5% from the $0.62 recording in Q2 2015.

| Intel Q2 2016 Financial Results (GAAP) | |||||

| Q2'2016 | Q1'2016 | Q2'2015 | |||

| Revenue | $13.5B | $13.7B | $13.2B | ||

| Operating Income | $1.3B | $2.6B | $2.9B | ||

| Net Income | $1.3B | $2.0B | $2.7B | ||

| Gross Margin | 58.9% | 59.3% | 62.5% | ||

| Client Computing Group Revenue | $7.5B | -3% | -3% | ||

| Data Center Group Revenue | $4.0B | +1% | +5% | ||

| Internet of Things Revenue | $572M | -12% | +2% | ||

| Non-Volatile Memory Solutions Group | $554M | -1% | -20% | ||

| Intel Security Group | $537M | flat | +10% | ||

| Programmable Solutions Group | $465M | +30% | - | ||

| All Other Revenue | $40M | -20% | -36.5% | ||

Looking forward to next quarter, Intel sees revenues at $14.9 billion, plus or minus $500 million, with margins around 60%, plus or minus a couple of percent.

Looking at the individual business lines, Intel now has a couple of additional business groupings. After the acquisition of Altera, the formed the Programmable Solutions Group, and they also have the New Technology Group to manage the products designed for wearables, cameras, and other segments. The longer tenured groups are still the Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, and Intel Security Group, as well as “All Other”.

The Client Computing Group is platforms for notebooks, desktops, tablets, phones, and wireless connectivity. This group had revenues of $7.3 billion for the quarter, down 3% year-over-year. Intel decreased sales of their notebook platforms by 5% compared to Q2 2015, but the average selling price increased 2%. Desktops decreased 7%, and average selling price increased 1%. Tablet platform volumes fell 49% to 5 million units. Overall, Client Computing Group unit volumes decreased 15% year-over-year, but average selling prices increased 13%.

The Data Center Group had revenues of $4.027 billion, which is up 5% year-over-year. Unit volumes were up 5% year-over-year, but average selling prices of this line was down 1%.

The Internet of Things group had revenues of $572 million, up 2% year-over-year, while the Non-Volatile Memory Solutions Group had revenues of $554 million, which is down 20% year-over-year. Intel Security Group revenue was up 10% year-over-year to $537 million, and the new Programmable Solutions Group had revenues of $465 million, up 30% from last quarter when they were acquired.

Intel’s quarter met their expectations, but the restructuring charges have taken a toll on their profitability. Perhaps the most exciting news from this announcement though is that Kaby Lake is now shipping, along side the latest 7360 LTE modem.

Source: Intel Investor Relations

4 Comments

View All Comments

serendip - Thursday, July 21, 2016 - link

How much could they have made from mobile SOCs? Maybe it was a good decision to leave that segment alone for ARM licensees to fight over.iwod - Friday, July 22, 2016 - link

Well time will tell. DC Shipment are already not growing as fast. Which is now driving majority of its profits. Since the TCO always flavour the high end performance, power efficient chips. Intel will likely have a lead on this for at least the next two node, that is up to 7nm 2022.But you cant always rely on the Cloud/DC to grow forever. I guess that is why Intel is betting on 5G, from Mobile 5G Modem to Backend SDN. For this reason I think Ericsson is a very good acquistion target for Intel.

JKflipflop98 - Monday, July 25, 2016 - link

Why would you think data center growth is slowing down? The more mobile phones there are doing more complex things, the more servers you need to service them all. The dinky little processor in your phone isn't powerful enough to really do anything on it's own. The backend server is doing all the actual work.Meteor2 - Wednesday, July 27, 2016 - link

Apple thinks otherwise.