NVIDIA Q1 FY 2020 Earnings Report: Post-Crypto Reset

by Brett Howse on May 17, 2019 7:10 PM EST- Posted in

- GPUs

- NVIDIA

- Financial Results

This week NVIDIA announced their earnings for the first quarter of their 2020 fiscal year, and although the crash in crypto-currency has been a boom for gamers wanting to buy GPUs, it has not been as welcome to the company’s Form 10-Q. Revenue for Q1 2020 fell 31% to $2.22 billion, with gross margin falling 6.1% from 64.5% to 58.4%. Operating expenses at the company were up 21% despite the downturn in revenue, with NVIDIA spending $132 million more this quarter on R&D than the same period a year ago. Operating income was down 72% to $358 million, although thanks to $44 million in interest income and $5 million in income tax benefit, net income came in at $394 million. Even though net was higher than operating, net was still down 68% compared to Q1 2019. This resulted in earnings-per-share of $0.64, down 68% from the $1.98 a year ago.

| NVIDIA Q1 2020 Financial Results (GAAP) | |||||

| Q1'2020 | Q4'2019 | Q1'2019 | Q/Q | Y/Y | |

| Revenue | $2220M | $2205M | $3207M | +1% | -31% |

| Gross Margin | 58.4% | 54.7% | 64.5% | +3.7% | -6.1% |

| Operating Income | $358M | $294M | $1295M | +22% | -72% |

| Net Income | $394M | $567M | $1244M | -31% | -68% |

| EPS | $0.64 | $0.92 | $1.98 | -30% | -68% |

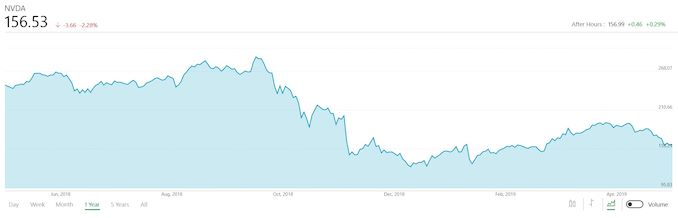

Although seeing such a drop is never good, some perspective is required. NVIDIA’s 2019 fiscal year was a standout. Revenue in Q1 2019 was $3.2 billion, with a net income of $1.2 billion. But if you go back to Q1 2018, revenue was $1.9 billion, and net income was $507 million, which is much closer to Q1 2020. Comparing Q1 2018 to Q1 2020 has 2020 up 14.6% on revenue, and net income down 28.6%. Clearly the inflated results thanks to a perfect storm for NVIDIA’s 2019 financials has ended though, and the company has been thrust back to reality. Luckily reality for the company is that a Q1 of $2.2 billion makes it easily their second best Q1 ever, so I think they’ll be OK.

Jumping into individual segments within the company, there are basically two products NVIDIA sells: GPU and Tegra. NVIDIA further breaks these down into subcategories, but NVIDIA at its heart is still a GPU company and its results prove that out. GPU revenue accounted for 91% of the company’s revenue, at $2.022 billion USD, and this segment had an operating income of $669 million. A year ago when crypto was king, GPU was $2.765 billion in revenue with an operating income of $1.394 billion. Revenue for GPU was down due to drops in gaming and data center revenue, as well as not having $289 million in revenue for cryptocurrency mining processors (CMP).

Tegra on the other hand was only $198 million in revenue for Q1 2020, with an operating loss of $44 million. A year ago, Tegra was $442 million in revenue and the segment was in the black, with an operating income of $97 million. The big drop for Tegra is a decline in SoC modules for gaming, which you can read as Nintendo Switch sales for the most part.

NVIDIA then shuffles all of these results into several other categories. Gaming is their largest, and Gaming had revenue of $1.05 billion, which is down 39% from a year ago. NVIDIA attributes this drop due to a decline in GPU shipments as well as a decline in SoC modules for gaming consoles.

Professional Visualization, which features the Quadro brand, had revenue of $266 million, up 6% from a year ago. NVIDIA has seen growth in both desktop and laptop workstation products compared to 2019.

Data Center had revenue for Q1 of $634 million, which is down 10% from a year ago. NVIDIA has seen some slowdown in the hyperscale and enterprise purchases of GPUs, but some growth in inference which has offset the drop somewhat.

Automotive had revenue of $166 million, up 14% from a year ago, attributed to growth in AI cockpit modules.

Finally, OEM and Other revenue was $99 million, down 74% from a year ago, which is not surprising since this is where NVIDIA stuck it’s CMP sales, meaning this entire drop can be attributed directly to cryptocurrency.

| NVIDIA Quarterly Revenue Comparison (GAAP) ($ in millions) |

|||||

| In millions | Q1'2020 | Q4'2019 | Q1'2019 | Q/Q | Y/Y |

| Gaming | $1055 | $954 | $1723 | +11% | -39% |

| Professional Visualization | $266 | $293 | $251 | -9% | +6% |

| Datacenter | $634 | $679 | $701 | -7% | +10% |

| Automotive | $166 | $163 | $145 | +2% | +14% |

| OEM & IP | $99 | $116 | $387 | -15% | -74% |

After a stellar FY 2019, the company has had to hit reset a bit. Q1 is well down compared to 2019, but luckily for the company, not so far off the year previous. Looking ahead to Q2 2020, NVIDIA is expecting revenue of $2.55 billion, plus or minus 2%, and gross margins 59.2% plus or minus 0.5%.

Source: NVIDIA Investor Relations

31 Comments

View All Comments

tfouto - Monday, May 20, 2019 - link

wtf. What's the purpose of that?No wonder the world is all fuc*ed up.

Qasar - Monday, May 20, 2019 - link

tfouto welcome to the business world.. thats how its done, and i think how it has always been done...peevee - Saturday, May 18, 2019 - link

I am terrible curious about their OEM &IP thing. It fell by the factor of 4 YoY (which the only one matters as sequential quarters are not comparable to each other)!So, one or both of the following has happened:

1) OEMs stopped installing NV chips in PCs. AMD APUs? Intel's CPU with AMD inside? Or did I miss an efficient mobile GPU from AMD everybody installs instead?

2) Some extremely valuable patents from 20 years ago have expired.

It would be nice if AT could investigate...

Brett Howse - Saturday, May 18, 2019 - link

I wrote specifically why in the article:Finally, OEM and Other revenue was $99 million, down 74% from a year ago, which is not surprising since this is where NVIDIA stuck it’s CMP sales, meaning this entire drop can be attributed directly to cryptocurrency.

BenSkywalker - Saturday, May 18, 2019 - link

"GPU revenue accounted for 91% of the company’s revenue"OEM includes Nintendo Switch sales- at this point that category, along with automotive, is almost if not entirely exclusively Tegra. I know it's not a huge difference, but Tegra is roughly 12%. Also their data center numbers likely include DGX sales which certainly give up more than 10% of their cost to non GPU hardware. Their revenue is still overwhelmingly GPU based, just not as much as maybe you are stating.

Brett Howse - Saturday, May 18, 2019 - link

What I stated was based on the numbers:Total revenue: $2220 Million

GPU: $2022 Million

Tegra: $198 Million

GPU is 91.08% and Tegra is 8.91%

jabbadap - Saturday, May 18, 2019 - link

No it's not, as article says Switch sales are under Gaming on that table like it have always been. Of course there might be some immaterial rights agreement with Nintendo on OEM/IP but I doubt it is tied on device sales.nunya112 - Saturday, May 18, 2019 - link

problem now is companies hate seeing lower numbers compared to last year. its a signal that the company is or isnt growing. which is bad for consumers. because that means price risesinvestors dont care about off this was cause of a crypto boom. they just see negative numbers.

Qasar - Monday, May 20, 2019 - link

nunya112 well.. thank the crypto boom, and collapse for that.. with nvidia.. they would raise or keep their prices high regardless.. with no one to challenge them.. they can charge what ever they like for their products....vailr - Wednesday, May 22, 2019 - link

Crypto-coin profitability has recently returned to levels of about the same as this time one year previous. One Bitcoin is currently valued at ~$7,900. It's about doubled in value over the last 6 weeks.